MMD BTZ

The MMD BTZ (Back To Zone) indicator for MT4/MT5 is an advanced analytical tool. It identifies historical price zones with high statistical probability of being revisited ("Back To Zone"), projecting them as key areas for future price action, thus supporting informed trading decisions.

Product information

MMD Diamond (BTZ) Indicator

Identify Statistically Significant "Back To Zone" Price Levels - For MT4 & MT5!

One Product, Two Platforms: Your purchase or download includes versions for both MetaTrader 4 and MetaTrader 5!

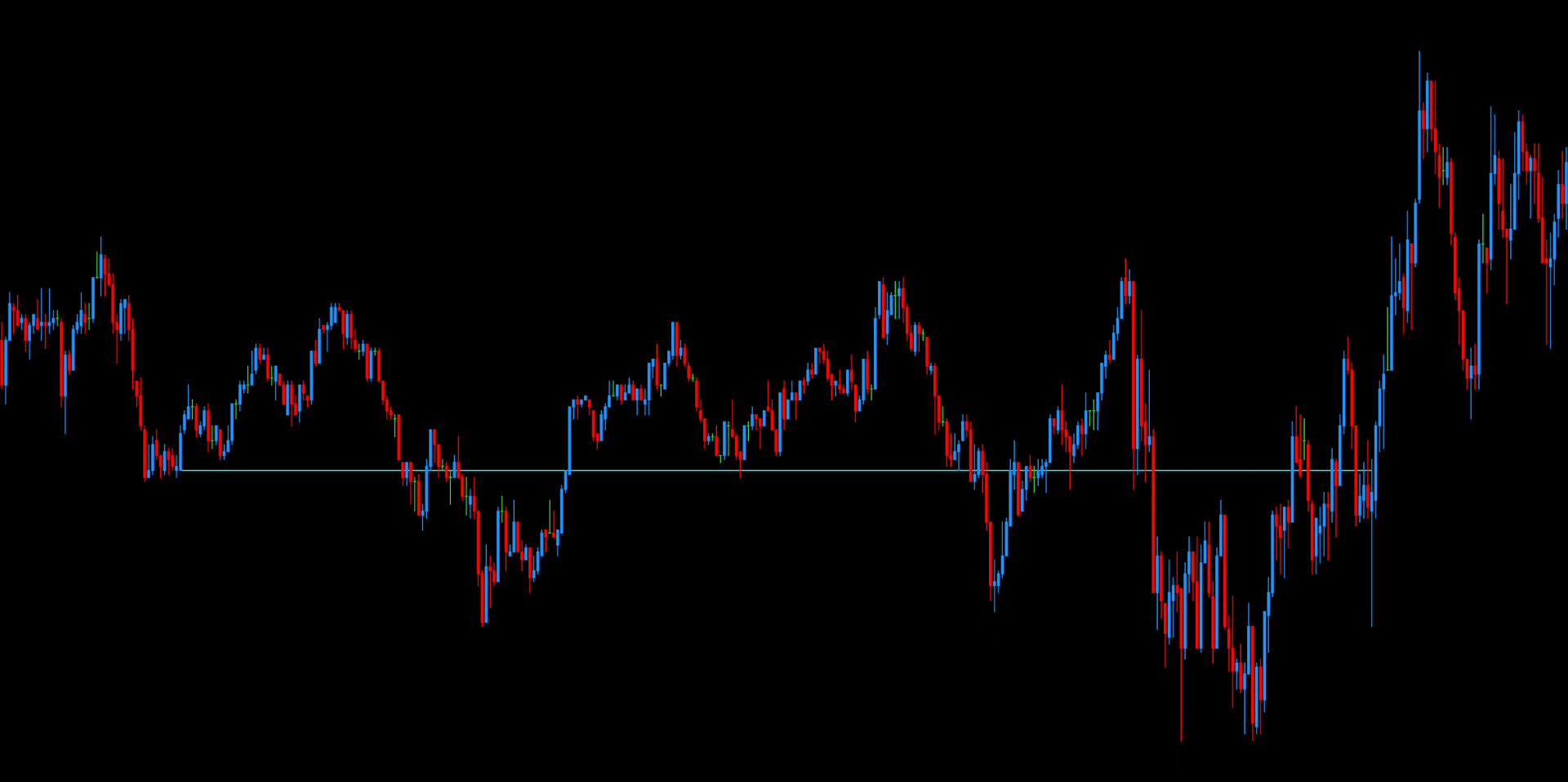

The MMD Diamond (BTZ - Back To Zone) indicator is an advanced analytical tool designed to identify price zones that the market statistically tends to revisit with remarkable regularity. It serves as a solid foundation for traders who seek not only a deeper understanding of market dynamics in a historical context, but also wish to leverage this insight to shape their current trading decisions.

The Power of "Back To Zone" (BTZ)

A key advantage of the MMD Diamond (BTZ) indicator is the ability to customize a wide range of parameters, such as timeframes, the breadth of analyzed periods, or the sensitivity level to price fluctuations. This flexibility allows each user to precisely define the conditions that best match their strategy and investment preferences. The indicator identifies these significant historical price levels or zones and projects them forward, creating potential areas of interest for future price action.

Moreover, the BTZ indicator can be integrated with various strategies based on the MMD methodology, including the 21:59 return model, the 2H350- pattern, or the Na-5 approach, as well as with proprietary concepts developed by individual traders.

Key Features & Benefits

- Statistical Zone Identification: Pinpoints historical price levels or zones with a high statistical probability of being revisited by the market.

- Flexible Trading Modes: Choose between two main operational modes:

- Trade on Level: Identifies a specific price level at a defined time (

Level Time) on a chosen day of the week (Level Day) and projects it forward for a set duration (Level Duration In Minutes). - Trade on Zone: Defines a zone based on price action between a

Zone Start TimeandZone End Timeon a chosenZone Day. The zone can be based on Open/Close (Zone_on_OC) or High/Low (Zone_on_HL) of that period and is projected forward for aZone Duration In Minutes.

- Trade on Level: Identifies a specific price level at a defined time (

- Comprehensive Customization: Tailor the indicator to your specific analytical needs:

- General BTZ Parameters:

Days Look Back: Number of past days to analyze for zone/level creation.Zone Color&Zone Line Color: Customize the appearance of the identified zones/levels.Line Style: Define the style of the projected lines.Extend Forward: How many bars the zone/level should be projected into the future.

- "Trade on Level" Specifics:

Level Day: Select a specific day of the week (Monday-Sunday) or "None" for all days.Level Time: Define the exact time to capture the price level (e.g., "8:00").Level Duration In Minutes: How long the projected level remains active/visible.

- "Trade on Zone" Specifics:

Zone Day: Select a specific day of the week or "None".Zone Start Time: Define the start time of the period to form the zone.Zone End Time: Define the end time of the period to form the zone.Zone Mode: Choose whether the zone is based on Open/Close prices or High/Low prices of the defined period.Zone Duration In Minutes: How long the projected zone remains active/visible.

- Button Control:

Show Button: Toggle the visibility of an on-chart button to show/hide BTZ zones.Button Text,Button Text Color,Button Font Size,Button Color: Customize button appearance.Button X Size,Button Y Size,Button X Position,Button Y Position,Buttons Corner Position: Full control over button placement.

- General BTZ Parameters:

- Historical Data Analysis: The visualization of statistically significant zones and the indicator’s intuitive interface facilitate in-depth research—both theoretical and practical. This makes it easier to test and refine one’s own systems, verify market hypotheses, and identify recurring price patterns.

- Foundation for Automated Strategies: A dedicated Expert Advisor (EA) has also been developed based on the BTZ indicator, utilizing the same model. As a result, the BTZ concept becomes a cornerstone for both manual and automated strategies.

- License Management: Securely managed via DLL for authorized use.

Practical Applications & Trading Ideas

The MMD Diamond (BTZ) indicator is a versatile tool for identifying key price areas. Its applications include, but are not limited to:

- Identifying Reversion Levels: Spotting zones where price has a high likelihood of returning after a deviation.

- Confirmation for Entries/Exits: Using BTZ zones as confirmation for trade entries or as potential take-profit or stop-loss areas.

- Strategy Development: Building robust trading strategies around statistically significant price behaviors, such as the "21:59 return model" or "2H350-" pattern.

A dedicated Expert Advisor (EA) has also been developed based on the BTZ indicator, utilizing the same model. As a result, the BTZ concept becomes a cornerstone for both manual and automated strategies, supporting traders in making well-informed decisions in a dynamic market environment.

If you have any questions related to this product, write to the email address: support@magiconcharts.com.

We will be happy to answer your questions promptly.